India Electric Vehicle Components Market Accelerates with Surge in EV Adoption 2030

India Electric Vehicle Components Market: Growth Acceleration Toward a New Automotive Era (2024–2030)

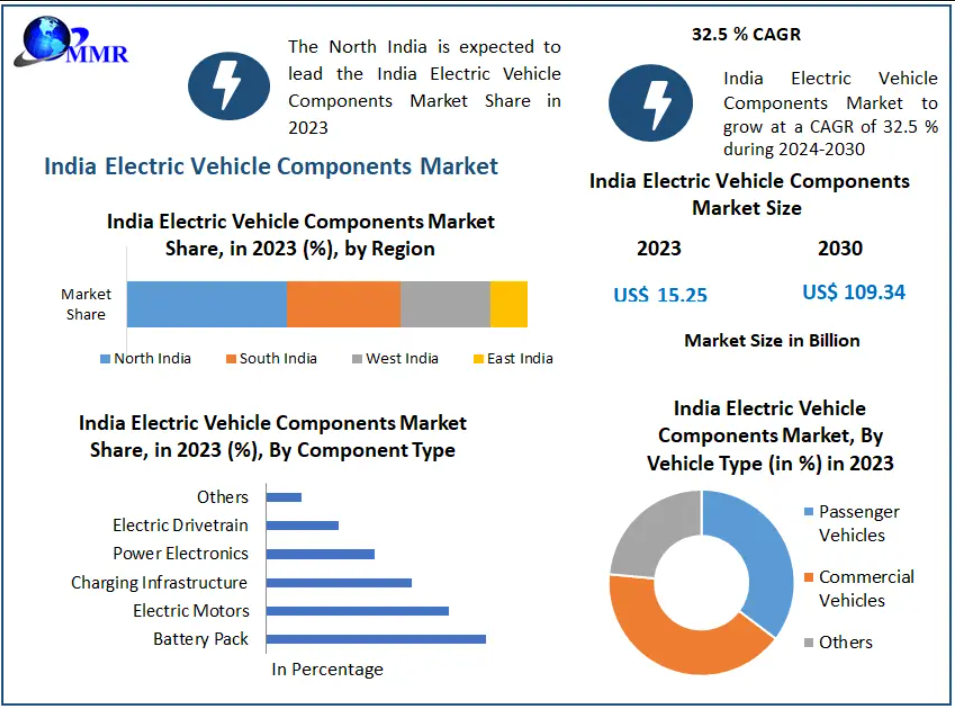

The India Electric Vehicle Components Market was valued and volumed at USD 15.25 billion in 2023 and is projected to reach USD 109.34 billion by 2030, expanding at a remarkable CAGR of 32.5%. As the nation moves boldly toward clean mobility, the EV components segment stands at the forefront of this transformation, supported by government incentives, rapid technological progress, and rising consumer adoption of electric vehicles.

Market Overview

India’s electric vehicle revolution is powered by an intricate ecosystem of advanced components that redefine automotive engineering. At the core lies the Traction Battery Pack, the primary energy source for EVs—accounting for 30–40% of the total EV cost. The DC-DC Converter ensures efficient power distribution between main and auxiliary systems, while the Electric Motor, available in both AC and DC variants, transforms stored electrical energy into mechanical power.

Another vital system, the Power Inverter, enables seamless energy conversion from DC to AC and vice versa, supporting speed regulation and regenerative braking. While India has historically depended on battery imports from China, Korea, and Japan, ongoing investments under the ₹5,000 crore Production Linked Incentive (PLI) scheme are catalyzing domestic manufacturing capabilities.

Driven by a combination of policy action, technology enhancement, and market demand, the India EV components landscape is evolving at an unprecedented pace.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/63133/

Market Dynamics

Driver: Growing Focus on Sustainability & Emission Reduction

India’s shift toward electric mobility is largely driven by its environmental commitments. With rising air pollution levels and depleting fossil fuel reserves, electric vehicles offer a zero tailpipe emission alternative that supports the country’s climate goals.

Key enablers include:

- Government support through FAME-II, tax rebates, and lower registration fees

- Lower operational costs compared to internal combustion engine (ICE) vehicles

- Reduced maintenance expenses due to fewer mechanical components

- Alignment with India's renewable energy goal of 40% power generation from non-fossil fuels by 2030

The combination of economic and environmental benefits is accelerating EV adoption, directly boosting component demand.

Trend: Rise of Indigenous EV Technologies & Local Manufacturing

A major trend shaping the market is India’s push toward self-reliance in EV component production. Under the Make in India initiative, domestic players are increasingly investing in R&D, battery chemistries, electric motors, controllers, inverters, and software-driven systems.

This wave of localization brings multiple advantages:

- Reduced dependence on imports

- Improved cost competitiveness

- Job creation and local skill development

- Enhanced export potential

- Strengthened EV supply chain resilience

Collaborations between automakers, battery companies, startups, and tech firms are fostering innovation, enabling India to rapidly scale homegrown EV technologies.

Restraint: High Initial Costs

Despite rapid advancements, the EV ecosystem still faces cost-related challenges:

- High battery prices, driven by expensive raw materials

- Limited manufacturing scale, causing higher per-unit production costs

- Need for heavy upfront investment in public and private charging infrastructure

- Import duties and currency fluctuations affecting component pricing

Until economies of scale improve and local manufacturing matures, high initial costs may restrict adoption pace—particularly in price-sensitive consumer segments.

Segment Analysis

By Propulsion Type

- Battery Electric Vehicles (BEVs) – Largest segment in 2023

- Zero tailpipe emissions

- Strong government incentives

- Falling battery costs

- Growing urban demand

BEVs have led component demand due to their complete dependence on electric propulsion systems, including larger battery packs, advanced motors, and integrated power electronics.

Regional Insights

India’s EV component market growth is widespread, but certain regions stand out:

North India – Emerging Adoption Hub

- Delhi NCR is a major EV adopter due to supportive policies

- Strong demand for charging infrastructure

- Presence of component manufacturers and EV assemblers

South India – Manufacturing & Innovation Leader

- Bengaluru: hub for EV startups, R&D centers, motor and drivetrain manufacturers

- Tamil Nadu: major automotive hub attracting large EV and battery companies

- Hyderabad: rapid growth in electronics and component supply chains

These regions contribute significantly to India's growing EV manufacturing capacity.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/63133/

Key Market Players

- SEG Automotive India Pvt. Ltd.

- Tata Motors Ltd.

- Mahindra Electric Mobility Ltd.

- Avtec Ltd.

- Exide Industries Ltd.

- Bosch Ltd.

- Ashok Leyland

- Maruti Suzuki

- Okaya Power Pvt. Ltd.

- Amara Raja Batteries Ltd.

- Sparco Batteries Pvt. Ltd.

- Eastman Auto & Power Ltd.

- Exicom Tele-Systems Ltd.

- Delta Electronics India

- Hero Electric Vehicles Pvt. Ltd.

These companies are actively developing components such as motors, chargers, power electronics, and battery systems, shaping India's EV future.

Conclusion

India’s Electric Vehicle Components Market is on a high-growth trajectory, driven by strong government support, increasing sustainability priorities, and rapid innovation. As domestic manufacturing expands and costs decline, India is poised to become a global hub for EV components, contributing to a cleaner, technologically advanced transportation ecosystem.

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Shopping

- Theater

- Wellness