Forklift Trucks Market Size, Share, and Growth Forecast 2025–2032

Forklift Trucks Market – Global Outlook, Trends, and Future Opportunities (2025–2032)

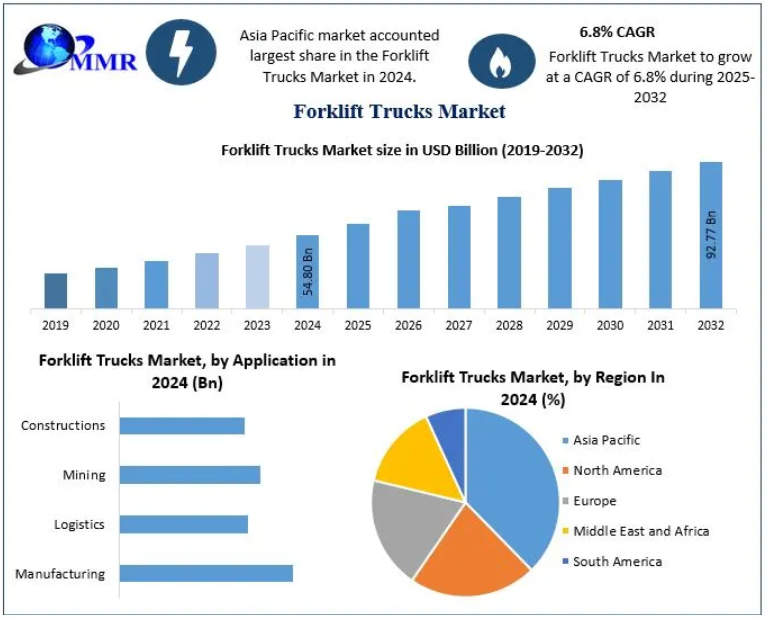

The Forklift Trucks Market, valued at USD 54.80 billion in 2024, is poised for strong expansion and is projected to reach USD 92.77 billion by 2032, accelerating at a CAGR of 6.8% from 2025 to 2032. Forklift trucks continue to be an indispensable part of industrial logistics, thanks to their efficiency in handling heavy loads, optimizing warehouse operations, and enabling seamless movement of goods across short distances.

Market Overview

Forklift trucks serve as essential material-handling equipment in warehouses, shipyards, manufacturing facilities, and logistics hubs. Their ability to lift, stack, and transport goods efficiently makes them an integral component of modern supply chain ecosystems.

The market features a wide range of classifications—Class 1 to Class 5 forklifts—each meeting specific industry applications and operational requirements. The integration of advanced attachments, such as clamps, rotators, platforms, and telescopic lifts, further enhances operational adaptability and cost-efficiency.

Driven by industrial automation, e-commerce expansion, and the modernization of logistics networks, the forklift industry is experiencing rapid technological advancements, especially in the adoption of electric and lithium-ion-powered forklifts.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/22075/

Impact of COVID-19 on the Market

The pandemic created significant disruptions across manufacturing, warehousing, and logistics sectors. Temporary production halts and warehouse closures led to steep declines in forklift demand during 2020. Supply chain bottlenecks, port congestion, and reduced international trade further deepened the downturn.

However, the post-pandemic recovery has been robust. A resurgence in global trade, rebuilding of inventory systems, expansion of e-commerce warehousing, and renewed government focus on infrastructure development have collectively strengthened forklift demand. The shift toward automation and intelligent warehouse solutions is expected to further accelerate market revival.

Key Market Dynamics

1. Rise of Electric Forklifts

Electric forklifts are witnessing unprecedented adoption due to:

- Lower operating and maintenance costs

- Improved energy efficiency

- Zero emissions, supporting sustainability goals

- Compliance with strict global emission regulations

Technological advancements in AC motors and lithium-ion batteries have enabled electric forklifts to match—and often surpass—the performance of internal combustion (IC) forklifts.

2. Infrastructure and Construction Growth

Infrastructure megaprojects, expanding industrial zones, and real estate development—especially in emerging economies such as China, India, Indonesia, and Australia—are driving increased demand for heavy-duty forklifts and telescopic handlers.

3. Safety Concerns

Forklift-related accidents remain a major challenge, with approximately 85 fatalities and nearly 35,000 serious injuries annually. The rising number of workplace safety incidents prompts companies to adopt:

- Advanced safety sensors

- Operator monitoring systems

- Automated guided forklifts (AGFs)

These innovations are expected to influence future purchasing decisions.

4. Raw Material & Maintenance Costs

The industry faces limitations due to:

- Fluctuating steel and battery raw material prices

- High maintenance and charging infrastructure costs

- Battery handling complexities in multi-shift operations

Such factors may restrain growth, particularly for small and medium enterprises.

Market Segmentation Analysis

By Class

Class 3 forklifts—including electric pallet trucks and warehouse walkers—dominated the market with over 39% share in 2024. Their cost-effectiveness and suitability for warehouses and e-commerce fulfillment centers fuel their continued dominance.

By Power Type

- Electric Forklifts: Held 66.2% share in 2024, expected to be the fastest-growing segment.

- Combustion Engines: Still essential for heavy outdoor operations but declining in mature markets due to sustainability regulations.

By Application

- Manufacturing leads the market as industries increasingly adopt automation and high-performance material-handling systems.

- Logistics and e-commerce continue rapid adoption of Class 3 and Class 1 electric forklifts.

- Mining and construction maintain steady demand for heavy-duty forklift models.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/22075/

Regional Insights

Asia Pacific – The Market Leader

With over 45% share in 2024, Asia Pacific remains the dominant region, supported by:

- Expanding manufacturing hubs

- Strong e-commerce ecosystems

- Rapid warehouse modernization

- Government-driven industrial automation initiatives

China, Japan, South Korea, and India are the major contributors.

North America

Adoption of electric forklifts is high due to stringent emission policies and a mature industrial ecosystem. Automation in warehouses and the growth of 3PL companies drive the U.S. market.

Europe

Energy efficiency regulations and sustainability mandates make Europe one of the fastest adopters of battery-powered and hydrogen fuel cell forklifts.

Middle East & Africa / South America

Growth is moderate, driven by construction projects, mining operations, and infrastructure development initiatives.

Competitive Landscape

The forklift industry is highly competitive, with global players investing in automation, telematics, and electric powertrain technologies. Major companies include:

- Toyota Material Handling

- Kion Group AG

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Anhui Heli Co. Ltd

- Hangcha Group Co. Ltd

- BYD

- Doosan Corporation

- Manitou Group

- Mitsubishi Nichiyu Forklift

- Unicarriers Forklift

- Caterpillar

- Komatsu Ltd

- Hyundai Material Handling

These companies focus on R&D, product diversification, AI-powered safety systems, and strategic partnerships to enhance market presence.

Future Outlook

The forklift trucks market is transitioning toward a high-performance, energy-efficient, and automated ecosystem. Key opportunities over the next decade include:

- Autonomous forklifts and AGVs

- Lithium-ion and hydrogen fuel cell technologies

- Predictive maintenance via IoT and telematics

- Smart warehouses integrated with robotics

- Safety compliance-driven forklift innovations

As industries prioritize automation and sustainability, forklift trucks will remain central to global material handling operations.

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Shopping

- Theater

- Wellness