Pharmaceutical Manufacturing Software Market Future Outlook: Innovations in Drug Manufacturing

Global Pharmaceutical Manufacturing Software Market: Trends, Dynamics, and Growth Forecast (2023–2029)

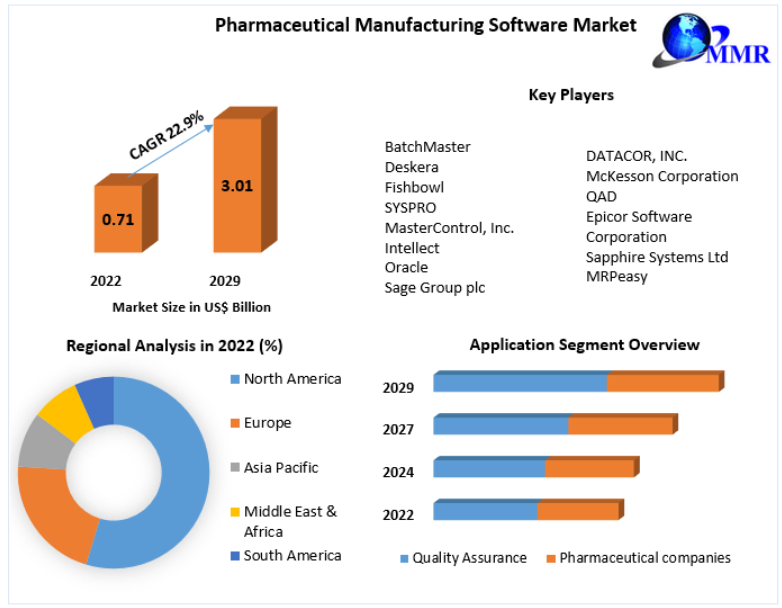

The Global Pharmaceutical Manufacturing Software Market was valued at USD 0.71 billion in 2022 and is projected to grow at a CAGR of 22.9%, reaching an estimated USD 3.01 billion by 2029. The increasing demand for compliance-driven digital solutions, automation, and quality management tools is driving rapid adoption across the pharmaceutical sector.

Market Overview

Pharmaceutical manufacturing software (PMS) is designed to streamline and optimize operations in drug development and production. These solutions help pharmaceutical companies manage:

- Compliance with cGMP regulations

- Standard operating procedures (SOPs), batch records (BMRs), and protocols

- Equipment maintenance, instrument calibration, and validation

- Clinical and preclinical trial management

During the COVID-19 pandemic, pharmaceutical software played a pivotal role in accelerating vaccine development and therapeutic solutions, highlighting its strategic importance in research and manufacturing.

The software supports large-scale operations, enhancing transparency, efficiency, and productivity while ensuring compliance with stringent regulatory requirements. Integration with tools like ERP (Enterprise Resource Planning), MES (Manufacturing Execution Systems), and cloud-based platforms further optimizes manufacturing processes.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/78546/

Market Dynamics

Growth Drivers

- Digital Transformation in Pharma

- Automation and cloud technologies enable real-time data management, reducing labor costs and operational inefficiencies.

- Virtual simulations and digital twins allow faster ramp-up of production systems and minimize validation time.

- ERP Integration

- ERP software in pharmaceutical manufacturing supports intelligent demand forecasting, financial management, inventory control, and formulation planning.

- Centralized management ensures compliance and enhances decision-making efficiency.

- Increased R&D and Clinical Trial Needs

- PMS accelerates drug development timelines through electronic case report forms (eCRFs) and electronic data capture (EDC) systems.

- Faster preclinical and clinical trial management enhances commercial drug readiness.

Challenges

- Price volatility, predatory pricing, and reverse-engineering of drugs create competitive pressures.

- Compliance with evolving government regulations and cGMP standards increases operational costs.

- Integration and implementation of complex software require substantial investments in infrastructure and training.

Opportunities

- Fast-Track Automation: Advanced tools like cloud-based simulations, digital twins, and predictive analytics enable quicker response to demand fluctuations.

- Modular Facility Construction: Coupled with automation, modular facilities allow flexible manufacturing and scalable production.

- Cloud Solutions: Adoption of cloud platforms reduces IT overheads, enhances data accessibility, and supports real-time analytics.

Market Segmentation

By Development Type

- Fast Track Automation (Dominant Segment)

Facilitates process simulations, virtual validation, and faster production ramp-up. - Enterprise Resource Planning (ERP)

Automates key business functions while ensuring compliance. - Cloud-Based Solutions

Provides real-time data access, scalability, and analytics-driven insights.

By Application

- Quality Assurance

- Pharmaceutical Companies

By Enterprise Size

- Large Enterprises (Dominant)

Benefit from streamlined operations, regulatory compliance, and workforce training. - SMEs

Growing adoption due to cost-effective cloud solutions and scalable automation tools.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/78546/

Regional Insights

- North America: Market leader due to strong pharmaceutical R&D infrastructure, adoption of ERP and cloud solutions, and a high volume of new drug development. Companies like ProcessPro leverage cloud platforms for real-time analytics and regulatory compliance.

- Europe: Growth driven by compliance-focused solutions, large pharma companies, and digitization initiatives.

- Asia Pacific: Rapid adoption in countries like China, India, Japan, and South Korea due to rising pharmaceutical manufacturing, investments in digital infrastructure, and increasing healthcare expenditure.

- Middle East & Africa: Emerging market opportunities driven by increasing pharmaceutical investments and modernization of manufacturing facilities.

- South America: Gradual growth supported by regional pharmaceutical expansion and digitalization efforts.

Competitive Landscape

The pharmaceutical manufacturing software market is highly competitive, with companies focusing on innovation, global expansion, and tailored solutions. Key market players include:

- BatchMaster

- Deskera

- Fishbowl

- SYSPRO

- MasterControl, Inc.

- Intellect

- Oracle

- Sage Group plc

- DATACOR, INC.

- McKesson Corporation

- QAD

- Epicor Software Corporation

- Sapphire Systems Ltd

- MRPeasy

These companies focus on offering scalable solutions, regulatory compliance, and cloud-based platforms while investing in R&D to maintain a competitive edge.

Conclusion

The Pharmaceutical Manufacturing Software Market is poised for rapid growth between 2023 and 2029. Rising demand for automation, cloud integration, and quality management solutions is reshaping the pharmaceutical manufacturing landscape. While regulatory compliance and high implementation costs pose challenges, opportunities in fast-track automation, ERP integration, and cloud-based platforms are expected to drive innovation and efficiency across the sector.

The market’s evolution will continue to support faster drug development, streamline manufacturing processes, and improve compliance, making pharmaceutical software an indispensable tool in modern healthcare and life sciences industries.

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Shopping

- Theater

- Wellness