Humira Biosimilar Market Size Projected to Reach USD 4.34 Million by 2032

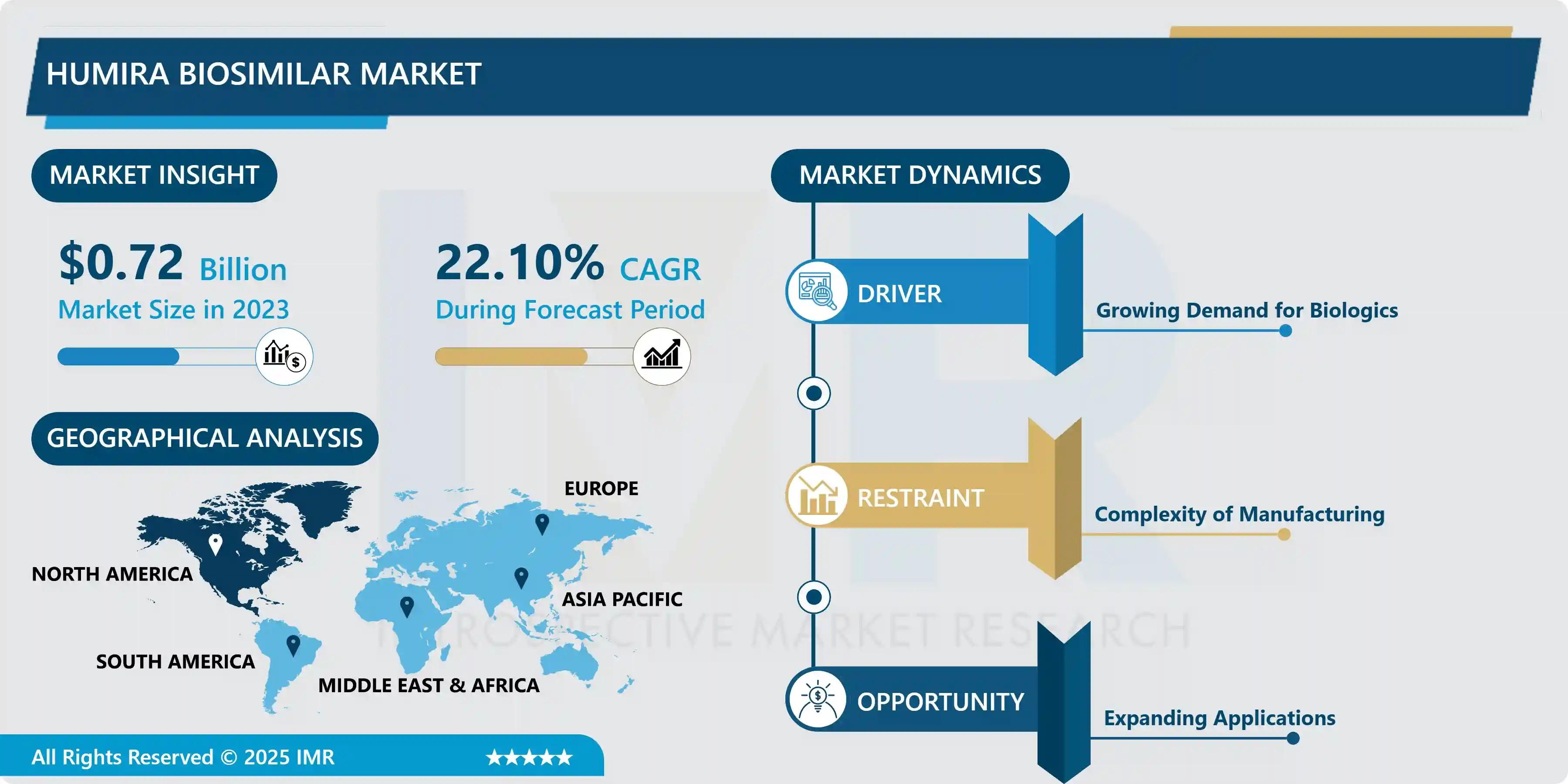

According to a new report published by Introspective Market Research, Humira Biosimilar Market by Product Type, Indication, and Distribution Channel, The Global Humira Biosimilar Market Size Was Valued at USD 0.72 Billion in 2023 and is Projected to Reach USD 4.34 Million by 2032, Growing at a CAGR of 22.1%.

Introduction / Market Overview

The Humira Biosimilar Market is witnessing rapid expansion driven by the growing adoption of cost-effective biologic alternatives for autoimmune and inflammatory disorders. Humira biosimilars are biologic medicines developed to match the reference product adalimumab in terms of safety, efficacy, and quality, while offering significant cost advantages over branded biologics.

These biosimilars are widely used in the treatment of rheumatoid arthritis, Crohn’s disease, psoriasis, ankylosing spondylitis, and ulcerative colitis. Increasing pressure to reduce healthcare expenditure, coupled with rising prevalence of chronic inflammatory diseases, is accelerating the uptake of Humira biosimilars across hospitals, specialty clinics, and retail pharmacy networks worldwide.

Growth Driver

A primary growth driver for the Humira biosimilar market is the increasing loss of exclusivity of branded biologics and the subsequent regulatory approvals for biosimilar products. Healthcare systems globally are promoting biosimilar adoption to reduce treatment costs without compromising clinical outcomes. Rising incidence of autoimmune diseases and improved physician confidence in biosimilar efficacy are further accelerating market growth. Additionally, favorable reimbursement policies and government initiatives supporting biosimilar penetration are strengthening demand, particularly in cost-sensitive healthcare markets.

Market Opportunity

The market presents strong opportunities through expanding biosimilar approvals in emerging economies and increasing patient access to biologic therapies. As regulatory frameworks become more streamlined, manufacturers are expected to accelerate product launches across Asia-Pacific and Latin America. Furthermore, increasing awareness among patients and clinicians regarding biosimilar safety and interchangeability offers long-term growth potential. Strategic partnerships, competitive pricing strategies, and investments in manufacturing scale-up are expected to unlock new revenue streams during the forecast period.

Humira Biosimilar Market, Segmentation

Segment A – By Product Type

Sub Segment A1: Approved Biosimilars

Sub Segment A2: Pipeline Biosimilars

Highest Market Share (2023): Approved Biosimilars

Approved biosimilars accounted for the highest market share in 2023 due to their established regulatory clearance and increasing acceptance among healthcare providers. These products offer proven therapeutic equivalence to reference biologics while delivering substantial cost savings. Their growing availability across developed markets and inclusion in hospital formularies has significantly contributed to their dominance in the overall Humira biosimilar landscape.

Segment B – By Indication

Sub Segment B1: Rheumatoid Arthritis

Sub Segment B2: Crohn’s Disease

Sub Segment B3: Psoriasis

Highest Market Share (2023): Rheumatoid Arthritis

Rheumatoid arthritis represented the leading indication segment owing to the high disease prevalence and long-term dependency on biologic therapies. Humira biosimilars provide a cost-effective solution for chronic disease management, driving strong demand across hospitals and specialty clinics. Increasing early diagnosis rates and expanding treatment access further reinforce the segment’s leadership.

Some of The Leading/Active Market Players Are-

- Amgen Inc. (USA)

- Sandoz Group AG (Switzerland)

- Boehringer Ingelheim (Germany)

- Samsung Bioepis (South Korea)

- Pfizer Inc. (USA)

- Viatris Inc. (USA)

- Fresenius Kabi (Germany)

- Biogen Inc. (USA)

- Celltrion Inc. (South Korea)

- Coherus BioSciences (USA)

and other active players.

Key Industry Developments

News 1:

In January 2024, Sandoz expanded the commercial availability of its adalimumab biosimilar across multiple European markets.

This expansion aims to increase patient access to affordable biologic therapies while supporting healthcare cost containment initiatives.

News 2:

In July 2024, Amgen strengthened its biosimilar portfolio through strategic pricing and distribution partnerships.

The initiative is designed to enhance market penetration and improve biosimilar adoption across hospital and retail pharmacy channels.

Key Findings of the Study

- Approved biosimilars dominate the market

- Rheumatoid arthritis is the leading indication

- North America leads in biosimilar adoption

- Cost containment is a major growth driver

- Regulatory support accelerates market expansion

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Shopping

- Theater

- Wellness