Global Aircraft Seating Market Growth Opportunities and Industry Analysis

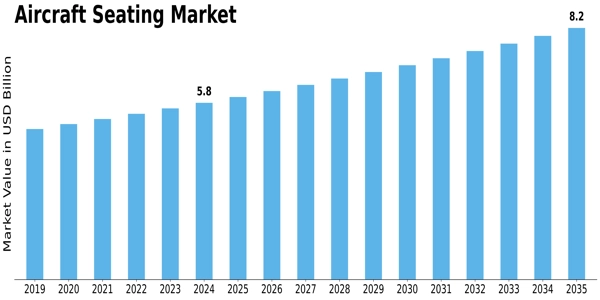

The global aircraft seating market is quietly gaining altitude, propelled by multiple aviation industry tailwinds. With a moderation in growth (CAGR around 3.26% from 2025 to 2035) and an expected market value of approximately USD 8.2 billion by 2035 (up from about USD 5.57 billion in 2023), the sector presents opportunities across design, engineering and aerospace supply chains.

Industry Overview

Aircraft seating is more than simply placing chairs inside cabins—it's about ergonomics, materials innovation, safety standards and operational efficiency. Airlines are under pressure to improve passenger satisfaction and optimise load factors, while manufacturers must meet strict certification requirements and pursue lightweight, modular and cost-effective seating solutions. The recovery of global air travel and the growth of airline fleets (especially narrow-body jets) underpin demand.

Market Outlook

The next decade is poised to bring incremental but steady growth in seating demand. Drivers include rising passenger volumes, renewed aircraft orders, replacement cycles for ageing fleets and innovation in seating design (e.g., premium economy, connectivity-enabled seats). Meanwhile, challenges such as high upfront installation costs, long aircraft service lives and supply-chain volatility temper the pace. Sustainability also looms large—airlines and OEMs are seeking seating solutions that reduce weight and materials waste while maintaining comfort.

Key Players’ Role

A number of strong players shape the competitive landscape. Companies like Sichuan Tengdun, Universal Aviation Seating, Recaro Aircraft Seating, Zodiac Aerospace and Thompson Aero Seating have created global footprints. These organisations emphasise advanced materials (composites, plastics), modular seat architectures and partnerships with leading airlines and airframers. They also invest in R&D to stay ahead of regulatory changes and airline preferences. For example, one firm may launch a new lightweight economy-class seat to satisfy low-cost carrier requirements, while another may focus on business-class suites for long-haul carriers.

Segmentation Growth

Segmentations reveal where growth is likely concentrated:

- Seat Type: Economy class remains dominant because of its volume; from about USD 2.88 billion in 2024 to ~USD 4.05 billion in 2035 for that category. Business class and premium economy are growing as airlines differentiate their offering.

- Materials: Leather remains a premium material, while fabric, plastic and metal are key in economy configurations. Plastics and metals (especially lightweight alloys) are increasingly important for fuel-saving objectives.

- Aircraft Type & End-User: Narrow-body aircraft account for the bulk of demand, due to their prevalence. In terms of end-users: commercial airlines dominate the seating market, followed by private aviation and military aviation segments.

- Region: North America leads in value share (around USD 2.25 billion in 2024), followed by Europe and Asia-Pacific (~USD 1.7 billion and USD 1.5 billion respectively in 2024). South America and Middle East & Africa are smaller today but expected to accelerate.

Final Insights

As global aviation rebounds and evolves, the seating market will reflect broader industry changes—from cabin reconfigurations to sustainability imperatives and passenger-centric innovation. Stakeholders that bring ergonomic design, lightweight materials and cost effectiveness together will gain competitive advantage. For airlines, seating investment acts as both customer-experience differentiator and operational lever.

Discover More Research Reports on Aerospace & Defense By Market Research Future:

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Shopping

- Theater

- Wellness