South Korea Foreign Exchange Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Foreign Exchange Market Report by Counterparty (Reporting Dealers, Non-Financial Customers, and Others), Type (Currency Swap, Outright Forward and FX Swaps, FX Options), and Region 2025-2033” This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Foreign Exchange Market Overview

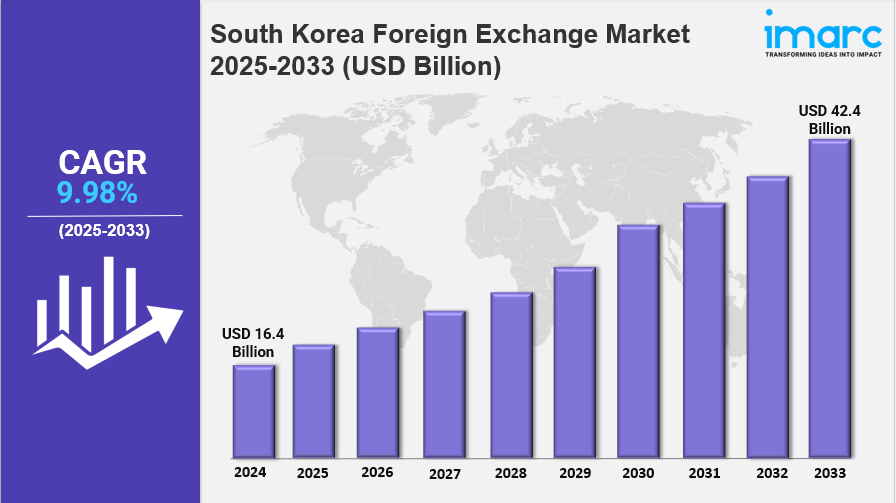

The South Korea foreign exchange market size of USD 16.4 Billion in 2024 and is projected to grow to USD 42.4 Billion by 2033. The market is expected to expand at a CAGR of 9.98% during the forecast period from 2025 to 2033. Growth is primarily driven by the increasing activity of forex traders who speculate on currency movements based on anticipated future changes.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Foreign Exchange Market Key Takeaways

- Current Market Size: USD 16.4 Billion in 2024

- CAGR: 9.98% during 2025-2033

- Forecast Period: 2025-2033

- The market is driven by the increasing prevalence of traders in the forex market engaging in speculative buying and selling of currencies.

- The foreign exchange market operates 24 hours a day, five days a week, due to the nature of currency trading.

- Key participants include banks, financial institutions, corporations, and individual traders.

- Central banks and governments influence currency values through monetary policies and interventions.

- Technological advancements like electronic trading platforms and algorithmic trading have significantly improved transaction efficiency.

Sample Request Link: https://www.imarcgroup.com/south-korea-foreign-exchange-market/requestsample

Market Growth Factors

The growth of the South Korea foreign exchange market is primarily fueled by the rise in speculative trading activities. Traders actively buy and sell foreign currencies based on expected future movements, contributing to increased market liquidity and trading volumes. This speculative activity is a key driver, as highlighted by the report's emphasis on the prevalence of traders in the market.

Economic indicators also play a critical role. Interest rates, GDP growth, employment figures, and manufacturing indices influence market volatility and currency valuations. Central banks’ adjustments to interest rates to control inflation and stimulate economic growth cause fluctuations in currency values, directly impacting the foreign exchange market’s expansion.

Additionally, political and regional factors further stimulate market activity. Political events such as elections, geopolitical tensions, and policy changes affect investor sentiment and currency valuations. Regional trade balances and tariffs also guide market movements. Technological innovations like electronic trading platforms, algorithmic trading, and high-frequency trading have enhanced the speed and efficiency of currency transactions, supporting market growth.

Market Segmentation

Counterparty Insights:

- Reporting Dealers: Entities that report transactions to regulatory authorities acting as market makers or intermediaries.

- Non-Financial Customers: Corporations and businesses engaging in forex to manage currency risk related to international trade.

- Others: Includes all other participants not classified as reporting dealers or non-financial customers.

Type Insights:

- Currency Swap: Agreements to exchange currency principals and interest payments between parties, commonly used to manage currency risk.

- Outright Forward and FX Swaps: Contracts to buy or sell currency at a future date at a predetermined rate, facilitating hedging and speculation.

- FX Options: Financial derivatives providing the right, but not the obligation, to buy or sell currencies at specified terms.

Ask For an Analyst-https://www.imarcgroup.com/request?type=report&id=19167&flag=C

Regional Insights

The dominant region in South Korea's foreign exchange market is the Seoul Capital Area, followed by Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others. The report provides a comprehensive regional analysis but does not specify precise market shares or CAGR by region. The Seoul Capital Area remains the most influential financial hub, driving the market dynamics throughout South Korea.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Shopping

- Theater

- Wellness