Thermal Ceramics Market Role in Decarbonization and Sustainable Manufacturing 2032

Thermal Ceramics Market – Global Industry Analysis & Forecast (2025–2032)

Market Overview

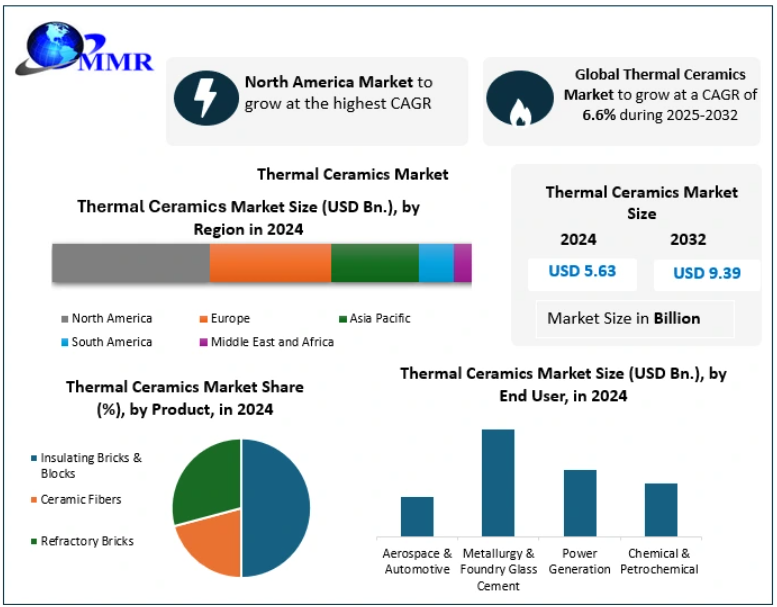

The global Thermal Ceramics Market was valued at USD 5.63 billion in 2024 and is projected to reach USD 9.39 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.6% during the forecast period. This growth reflects the expanding role of high‑temperature insulation materials in modern industrial systems, driven by energy efficiency mandates, industrial expansion, and the rising complexity of high‑temperature manufacturing processes.

Thermal ceramics are advanced refractory insulation materials engineered to withstand extreme temperatures while minimizing heat loss and enhancing operational safety. These materials are widely deployed in furnaces, kilns, boilers, turbines, and petrochemical reactors across industries such as metallurgy, glass, cement, chemicals, power generation, aerospace, and automotive manufacturing. Over time, the industry has transitioned from heavy, dense refractories to lightweight, low‑thermal‑conductivity, and chemically stable insulation systems that reduce fuel consumption and extend equipment life.

Unlock Insights: Request a Free Sample of Our Latest Report Now@https://www.maximizemarketresearch.com/request-sample/22702/

Market Drivers

Rising Demand for Energy‑Efficient Industrial Insulation

Global pressure to reduce energy losses and greenhouse gas emissions is a major catalyst for the thermal ceramics market. High‑temperature insulation systems significantly lower heat leakage from furnaces and reactors, enabling industries to reduce fuel usage, operating costs, and carbon footprints. Regulations such as the EU Energy Efficiency Directive and similar frameworks in North America and Asia are accelerating the adoption of advanced ceramic insulation materials.

Rapid Industrialization and Infrastructure Expansion

Accelerated industrial growth in emerging economies—particularly China, India, and Southeast Asia—is strengthening demand for refractory and insulating ceramics. Expanding steel, cement, glass, and non‑ferrous metal production facilities require reliable thermal management systems for molten metal handling, sintering, and continuous casting operations.

Lightweighting and Performance in Automotive and Aerospace

The automotive industry’s shift toward lightweight components to improve fuel economy and meet emission targets has increased the use of ceramic fiber insulation in exhaust systems, catalytic converters, and thermal shields. In aerospace, thermal ceramics are critical for engine linings, heat shields, and advanced propulsion systems, where extreme temperature resistance and weight reduction are essential.

Growth in Electric Mobility and Battery Thermal Management

Thermal ceramics are increasingly used in electric vehicle (EV) battery insulation, fire protection barriers, and thermal runaway containment systems. As global EV production scales up, demand for high‑performance ceramic insulation materials continues to rise.

Market Restraints

High Initial Investment and Installation Costs

Thermal ceramics infrastructure requires substantial upfront capital, including specialized furnaces, installation systems, and skilled labor. These costs can discourage small and mid‑sized manufacturers from adopting ceramic insulation technologies, limiting penetration in cost‑sensitive markets.

Raw Material Price Volatility

Key inputs such as alumina and zirconia experience significant price fluctuations, impacting production costs and profit margins for manufacturers. This volatility complicates long‑term pricing strategies and contract stability.

Environmental and Regulatory Pressures

Traditional refractory ceramic fibers face regulatory scrutiny due to health and environmental concerns. Compliance with evolving safety standards necessitates continuous product reformulation and process upgrades, increasing operational complexity and development costs.

Market Opportunities

Adoption of Bio‑Soluble and Eco‑Friendly Fibers

The transition from conventional refractory ceramic fibers to bio‑soluble and low‑biopersistence fibers represents a major growth opportunity. These materials address occupational health concerns while maintaining high thermal performance, making them particularly attractive in Europe and North America.

Digitalization and Smart Furnace Technologies

Integration of thermal ceramics with digitally monitored furnaces and predictive maintenance systems is improving energy optimization, extending lining life, and reducing downtime. Advanced insulation solutions compatible with Industry 4.0 platforms are gaining traction in high‑end manufacturing environments.

Expansion in Renewable Energy and Hydrogen Processing

Thermal ceramics are finding new applications in solar thermal plants, biomass gasifiers, hydrogen reformers, and energy storage systems, supporting the global transition toward cleaner energy technologies.

Segment Analysis

By Product Type

Insulating bricks and blocks dominated the market in 2024, supported by their widespread use in furnace walls, kilns, and high‑load industrial chambers. These materials provide excellent mechanical strength, dimensional stability, and long service life.

Ceramic fibers are gaining popularity for applications requiring flexibility, lightweight structures, and complex geometries, particularly in automotive exhaust systems, aerospace engines, and compact industrial furnaces.

Blankets and modules are increasingly adopted for rapid installation and modular furnace linings, reducing maintenance time and enabling uniform heat distribution. Boards, papers, and coatings address niche requirements such as electronics insulation, fire protection, and specialty manufacturing processes.

By Temperature Range

- Low temperature (<1000 °C): Used in boilers, ovens, and auxiliary industrial equipment

- Medium temperature (1000–1600 °C): Dominant in metallurgy, glass melting, and cement kilns

- High temperature (>1600 °C): Applied in advanced aerospace systems, specialty metallurgy, and ultra‑high‑temperature furnaces

By End‑Use Industry

Metallurgy and foundry operations remain the largest consumers due to continuous steel and non‑ferrous metal production. Power generation, chemicals, petrochemicals, cement, glass, aerospace, and automotive industries represent rapidly growing application segments driven by efficiency and safety requirements.

Unlock Insights: Request a Free Sample of Our Latest Report Now@https://www.maximizemarketresearch.com/request-sample/22702/

Regional Analysis

North America – Technological Leadership

North America leads in advanced thermal ceramics adoption, particularly in electronics, aerospace, power electronics, and automotive manufacturing. Strong R&D capabilities, stringent energy efficiency regulations, and a robust industrial base support sustained regional demand.

Europe – Sustainability‑Driven Growth

Europe benefits from strict environmental policies and strong innovation in refractory technologies. Germany, France, and the UK remain key contributors, particularly in automotive, aerospace, and high‑voltage electronics applications.

Asia Pacific – Fastest Growing Region

Asia Pacific represents the fastest‑growing market, driven by massive industrialization, expanding steel and cement capacities, and large‑scale infrastructure investments. China, India, Japan, and South Korea are major consumption hubs supported by domestic manufacturing ecosystems and rising export activity.

Competitive Landscape

The thermal ceramics market is moderately consolidated, with global leaders focusing on energy‑efficient formulations, fiber innovation, modular systems, and environmentally compliant products. Competitive strategies emphasize product differentiation, regional expansion, and strategic partnerships with furnace manufacturers and end‑use industries.

Key Market Participants Include:

- Morgan Advanced Materials (UK)

- Unifrax (USA)

- RHI Magnesita (Austria)

- Saint‑Gobain (France)

- CeramTec GmbH (Germany)

- Isolite Insulating Products (Japan)

- IBIDEN Co., Ltd. (Japan)

- Shandong Luyang Share (China)

- CCEWOOL (China)

- 3M Company (USA)

Market Trends

- Rising adoption of energy‑efficient insulation systems to meet decarbonization targets

- Growing use in electric vehicle battery protection and fire barriers

- Shift toward bio‑soluble and environmentally safer fibers

- Expansion of ceramic modules and prefabricated furnace linings

- Integration with smart furnace and digital monitoring platforms

Recent Developments

- Launch of next‑generation sintering furnaces with enhanced thermal efficiency in Germany

- Introduction of recyclable packaging and modular insulation systems in China

- Breakthrough ultra‑high‑temperature ceramic coatings for aerospace propulsion in India

- Continued EU funding for ceramic matrix composites in thermal protection systems

- Expansion of additive manufacturing applications in thermal ceramics showcased in the United States

Market Outlook

The thermal ceramics market is positioned for sustained long‑term expansion as industries pursue higher efficiency, lower emissions, and safer high‑temperature operations. Technological innovation, electrification of transport, renewable energy deployment, and emerging applications in advanced manufacturing will continue to reshape the competitive landscape.

By 2032, thermal ceramics are expected to become integral to energy‑optimized industrial infrastructure, advanced mobility systems, and next‑generation aerospace technologies, reinforcing their strategic importance in global industrial development.

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Shopping

- Theater

- Wellness