Solid Waste Management Market Trends Driving Sustainable Urban Development 2030

Global Solid Waste Management Market: Growth Outlook and Industry Trends

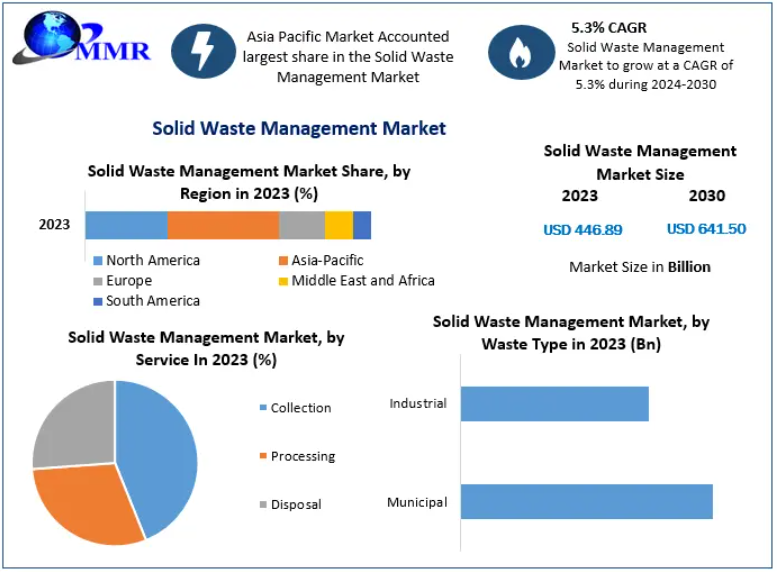

The Global Solid Waste Management Market was valued at USD 446.89 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030, reaching approximately USD 641.50 billion by 2030. This robust growth reflects the rising urgency to manage escalating waste volumes driven by urbanization, population growth, industrialization, and heightened environmental awareness.

Solid waste management (SWM) encompasses the systematic collection, transportation, processing, recycling, and disposal of non-liquid waste. It forms a critical pillar of environmental sustainability by minimizing pollution, conserving natural resources, and safeguarding public health. Efficient SWM systems are integral to urban infrastructure and play a decisive role in mitigating greenhouse gas emissions, particularly methane released from landfills.

Globally, cities currently generate over 1.3 billion tonnes of solid waste annually, a figure expected to surge to 2.2 billion tonnes by 2025 and further beyond. This rapid escalation underscores the growing need for advanced, scalable, and sustainable solid waste management solutions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/221732/

Solid Waste Management Market Dynamics

Growing Environmental Awareness Driving Market Expansion

Rising awareness of environmental protection and sustainable living is a key driver of the Solid Waste Management Market. Across both developed and emerging economies, consumers are becoming increasingly conscious of waste generation, recycling practices, and responsible consumption.

Market surveys indicate a clear shift in consumer attitudes toward environmental responsibility. Nearly 46% of consumers globally now fall into environmentally aware segments that actively consider sustainability in purchasing and lifestyle decisions. Countries such as India, China, Brazil, Mexico, and Italy show particularly high levels of environmental concern, accelerating demand for organized waste collection, recycling, and disposal systems.

Even among less environmentally active groups, recycling and waste segregation behaviors are gradually increasing. This broad-based awareness is strengthening public support for waste management infrastructure, regulatory enforcement, and private sector participation.

Rapid Urbanization Increasing Waste Generation

Urban population growth is another powerful driver fueling the demand for solid waste management services. Currently, 55% of the global population resides in urban areas, a proportion expected to rise to 68% by 2050. Urbanization alone is projected to add 2.5 billion people to cities by mid-century, with nearly 90% of this growth occurring in Asia and Africa.

India, China, and Nigeria together are expected to account for 35% of global urban population growth between 2018 and 2050. This rapid urban expansion is significantly increasing municipal solid waste volumes, often outpacing the development of collection, processing, and disposal infrastructure.

As urban density rises, municipalities are under growing pressure to deploy efficient, scalable solid waste management systems to maintain environmental quality and public health standards.

Technological Innovation Creating Market Opportunities

Automation and Smart Waste Management Solutions

The adoption of automated and technology-driven waste management systems represents a major growth opportunity for market participants. In response to stringent regulations and sustainability goals, municipalities worldwide are increasingly deploying automated waste collection systems (AWCS) that reduce manual handling, improve efficiency, and enhance hygiene.

Modern SWM solutions are integrating Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics to optimize waste collection routes, improve sorting accuracy, and minimize operational costs. AI-enabled robotic sorting systems are increasingly used in recycling facilities to reduce contamination and improve material recovery rates.

Additionally, emerging technologies such as waste-to-energy (WtE) incineration, anaerobic digestion, and bio-methanization are transforming waste into valuable energy resources, supporting circular economy objectives and reducing landfill dependency.

Market Challenges

Despite progress, the solid waste management sector continues to face significant challenges, particularly in developing economies. Many countries struggle with basic waste collection coverage, insufficient processing facilities, and poorly managed disposal sites. Limited financial resources, lack of technical expertise, and weak institutional frameworks further constrain effective waste management.

Public resistance to the siting of new waste treatment facilities remains a major hurdle, especially in densely populated urban areas. Additionally, the absence of reliable, transparent waste data complicates planning and investment decisions.

Improving inter-sectoral cooperation, enhancing data collection systems, and prioritizing waste prevention and resource recovery remain critical challenges for the industry’s long-term sustainability.

Regulatory Framework Overview

Europe

The European Union has established one of the world’s most comprehensive solid waste management regulatory frameworks. Directives such as the Waste Framework Directive, Landfill Directive, and Packaging and Packaging Waste Directive set strict targets for waste reduction, recycling, and landfill diversion, promoting harmonized practices across member states.

North America

In the United States, solid waste management is governed primarily by the Resource Conservation and Recovery Act (RCRA) and the Clean Water Act (CWA). State-level regulations often impose stricter standards, fostering innovation and private sector participation.

Asia

Asian countries display wide regulatory diversity. Nations like Japan and South Korea have highly advanced waste management systems with strong recycling performance, while rapidly urbanizing countries such as India and China continue to scale infrastructure to manage expanding waste streams.

Africa

Many African nations face weak regulatory enforcement and limited infrastructure, resulting in widespread informal waste disposal. However, growing awareness and international support are driving the development of structured solid waste management frameworks across the region.

Market Segmentation Analysis

By Waste Type

Municipal solid waste (MSW) represents the largest segment, accounting for over 60% of the global market share by 2030. MSW volumes are growing faster than urbanization itself, making municipal waste management the most critical service for cities worldwide.

By Application

The market is segmented into residential, commercial, and industrial applications.

- The residential sector dominated the market in 2023, accounting for 42.8% of global revenue.

- The commercial segment followed with 31.2%, while

- The industrial segment accounted for 26.0%.

Rising household consumption and lifestyle changes are driving residential waste volumes, while governments increasingly promote automated collection systems to enhance efficiency.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/221732/

Regional Insights

Asia Pacific Leads the Global Market

The Asia Pacific region accounts for over 40% of the global solid waste management market, driven by rapid urbanization, population growth, and rising consumption levels. The region generates approximately 1.3 billion tonnes of municipal solid waste annually, projected to reach 2.3 billion tonnes by 2030.

China is the largest market in the region, followed by India and Indonesia. Government-backed programs, international funding, and public-private partnerships are accelerating infrastructure development and technology adoption.

Regional Program Highlights

Countries across Asia and Europe are investing heavily in waste management reforms:

- Indonesia is implementing a national SWM reform program across 70 cities with international financial support to modernize collection and landfill infrastructure.

- China is promoting household waste segregation through incentive-based programs and expanding anaerobic digestion facilities.

- Vietnam and the Philippines are strengthening waste systems to reduce marine pollution and flood risk.

- Eastern European nations, including Belarus, Azerbaijan, and Bosnia & Herzegovina, are leveraging international funding to expand landfill rehabilitation, recycling, and regional waste facilities.

India Solid Waste Management Market Outlook

India’s solid waste management sector is undergoing rapid transformation, driven by urban expansion, regulatory reforms, and flagship initiatives such as Swachh Bharat Abhiyan. States like Andhra Pradesh, Gujarat, and Maharashtra have made significant progress in door-to-door collection, waste segregation, composting, bio-methanization, RDF production, and waste-to-energy projects.

Large urban centers such as Mumbai have mandated in-situ waste treatment for bulk waste generators, reflecting a shift toward decentralized and sustainable waste processing models. Continued government and private sector investment is expected to further strengthen India’s SWM ecosystem.

Competitive Landscape

The global solid waste management market features a diverse and competitive landscape shaped by regional regulations, technological innovation, and consolidation strategies. Leading companies focus on expanding service portfolios, investing in advanced processing technologies, and strengthening regional presence through acquisitions and partnerships.

Market Scope Snapshot

- Base Year: 2023

- Forecast Period: 2024–2030

- Market Size (2023): USD 446.89 Billion

- Market Size (2030): USD 641.50 Billion

- CAGR: 5.3%

Key Segments:

- Waste Type: Municipal, Industrial

- Service: Collection, Processing, Disposal

- End User: Residential, Commercial, Industrial

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Shopping

- Theater

- Wellness