Why Every Finance Professional Should Understand U.S. GAAP

In the world of accounting and finance, U.S. GAAP — or Generally Accepted Accounting Principles — forms the foundation for how financial information is recorded, reported, and interpreted. Whether you’re a seasoned accountant, a business owner, or a startup founder, understanding the basics of U.S. GAAP is crucial to making informed financial decisions and staying compliant.

In this article, we’ll break down what U.S. GAAP Basics is, why it matters, and how it impacts the way businesses operate today.

What Is U.S. GAAP?

U.S. GAAP (Generally Accepted Accounting Principles) refers to a standardized set of accounting rules, conventions, and procedures that companies in the United States must follow when preparing financial statements.

These principles are designed to ensure consistency, transparency, and comparability in financial reporting, so investors, regulators, and stakeholders can accurately evaluate a company’s financial health.

U.S. GAAP is governed by the Financial Accounting Standards Board (FASB), which develops and updates accounting standards through an extensive due process that includes public input and expert analysis.

Why U.S. GAAP Matters

Without a consistent framework like GAAP, financial statements could vary widely in format and interpretation, making it nearly impossible to compare two companies accurately.

Here’s why U.S. GAAP is so important:

-

Consistency: GAAP ensures that financial statements are prepared using the same methods, allowing for consistent comparisons across industries and time periods.

-

Credibility: Investors, lenders, and regulators rely on GAAP-compliant reports to make decisions based on trustworthy data.

-

Transparency: GAAP promotes full disclosure of financial information, reducing the risk of manipulation or misinterpretation.

-

Legal Requirement: Publicly traded companies in the U.S. are required by the Securities and Exchange Commission (SEC) to prepare their financial statements in accordance with GAAP.

Even privately held businesses often follow GAAP voluntarily because it increases the reliability of their financial reporting and strengthens relationships with investors and banks.

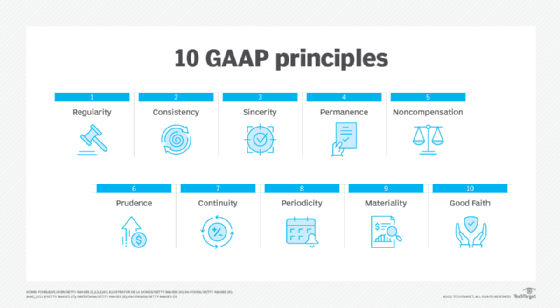

The Core Principles of U.S. GAAP

U.S. GAAP is built around a set of fundamental principles and concepts that guide accountants in preparing accurate financial statements.

Let’s look at the most important ones:

1. Principle of Regularity

Accountants must strictly adhere to established GAAP rules and standards, maintaining consistency and discipline in reporting.

2. Principle of Consistency

Once a company chooses an accounting method (e.g., inventory valuation or depreciation), it should use that same method year after year unless a justified change is disclosed.

3. Principle of Sincerity

Financial statements must reflect the company’s actual financial position without bias or manipulation.

4. Principle of Prudence (Conservatism)

Accountants should not overstate revenues or assets and should recognize expenses and liabilities as soon as they are probable.

5. Principle of Permanence of Methods

Using consistent procedures over time allows for meaningful comparisons across reporting periods.

6. Principle of Non-Compensation

All aspects of performance—profits, losses, assets, and liabilities—must be reported separately without offsetting one against another.

7. Principle of Full Disclosure

All relevant financial information that could influence decision-making must be disclosed in the financial statements or accompanying notes.

Key Components of Financial Statements Under U.S. GAAP

To comply with GAAP, companies typically prepare four core financial statements:

-

Balance Sheet (Statement of Financial Position):

Shows a company’s assets, liabilities, and equity at a specific point in time. -

Income Statement (Profit and Loss Statement):

Summarizes revenues, expenses, and profits over a reporting period. -

Statement of Cash Flows:

Tracks cash inflows and outflows from operations, investing, and financing activities. -

Statement of Changes in Equity:

Details changes in owners’ equity, such as retained earnings or issued shares.

Together, these statements provide a comprehensive picture of a company’s financial performance and stability.

U.S. GAAP vs. IFRS: What’s the Difference?

While U.S. GAAP is used primarily in the United States, many other countries follow the International Financial Reporting Standards (IFRS).

Here are a few key differences between the two frameworks:

-

Approach: GAAP is more rules-based, while IFRS is more principles-based, allowing for broader interpretation.

-

Inventory Valuation: GAAP allows the LIFO (Last In, First Out) method; IFRS does not.

-

Development Costs: Under IFRS, certain development costs can be capitalized, whereas GAAP typically requires them to be expensed immediately.

-

Revaluation of Assets: IFRS allows periodic revaluation of fixed assets, but GAAP generally records them at historical cost.

For global companies operating in multiple jurisdictions, understanding these differences is essential to maintain compliance and consistency across reporting standards.

Recent Developments in U.S. GAAP (2025 Update)

U.S. GAAP continues to evolve as business models and financial environments change. Some of the most recent focus areas include:

-

Revenue Recognition (ASC 606): Standardizing how and when revenue is recognized across industries.

-

Leases (ASC 842): Requiring companies to recognize lease liabilities and right-of-use assets on the balance sheet.

-

Credit Losses (CECL Model): Introducing a forward-looking approach to estimating credit losses for financial institutions.

-

Disclosure Improvements: Enhancing the clarity and relevance of notes to financial statements.

Staying up to date with new FASB updates is essential for accountants and business owners to remain compliant and accurate in reporting.

Why Business Owners Should Understand U.S. GAAP

Even if you’re not an accountant, having a basic understanding of GAAP gives you a clearer view of your company’s financial performance.

It helps you:

-

Interpret financial reports more accurately

-

Communicate effectively with accountants and auditors

-

Make informed strategic and investment decisions

-

Present credible financial information to investors or lenders

In short, U.S. GAAP ensures that everyone — from executives to investors — speaks the same “financial language.”

Final Thoughts

Understanding U.S. GAAP basics isn’t just about following accounting rules — it’s about building a solid financial foundation for your business.

By adhering to GAAP standards, companies create transparent, reliable, and comparable financial statements that instill confidence among investors, regulators, and management.

As financial regulations continue to evolve, staying informed about GAAP principles and updates will help your business stay compliant, competitive, and financially sound in 2025 and beyond.

Whether you’re managing a small business or running a public company, one thing is certain: U.S. GAAP remains the gold standard for trustworthy financial reporting.

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Shopping

- Theater

- Wellness