Credit Card Fraud Detection Platform Market Size, Growth, Analysis & Forecast Report,2033 | UnivDatos

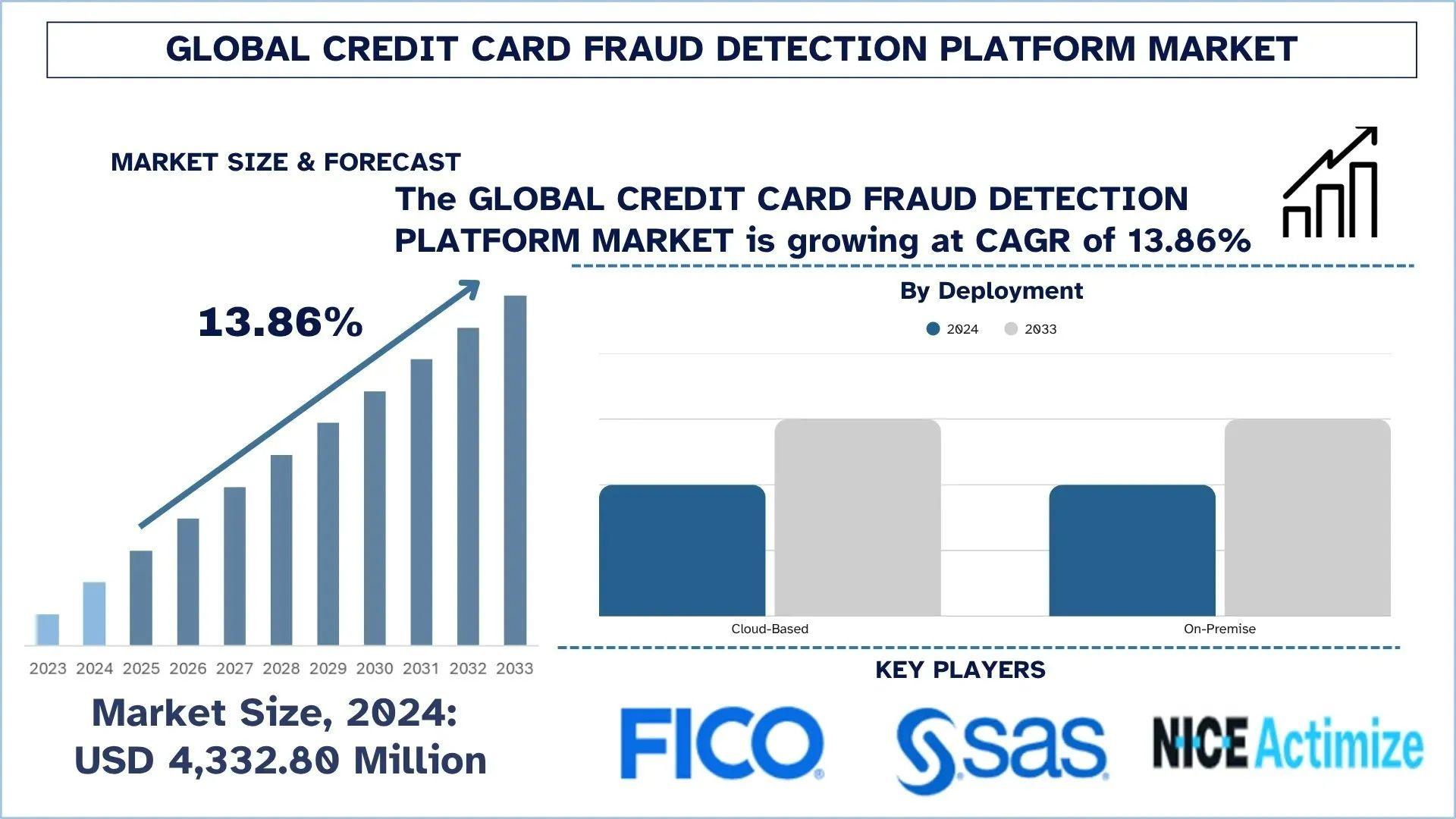

According to a new report by UnivDatos, The Credit Card Fraud Detection Platform Market is expected to reach USD million in 2033 by growing at a CAGR of 13.86% during the forecast period (2025- 2033F). The global market is encouraged by increasing rates of digital payment fraud in banking, e-commerce, and fintech sectors. Credit card fraud detection systems are necessary to analyze the patterns of transactions, detect anomalies, and thwart unauthorized activity with high accuracy, speed, and scalability. High-tech solutions based on artificial intelligence (AI), machine learning (ML), and behavioral analytics are under development and are already being deployed in real-time fraud prevention and identity verification. The general acceptance of cloud-based security infrastructure, the introduction of automation in fraud detection systems, and the pressure of consumers in seeking secure online deals are also further driving growth in the market. Privacy-compliant, energy-efficient, and adaptive fraud detection technologies introduced will contribute to the market becoming more resilient and sustainable over time.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/credit-card-fraud-detection-platform-market?popup=report-enquiry

Segments that transform the industry

- The Cloud-Based segment is expected to dominate the market and maintain its leadership throughout the forecast period. Cloud-based systems are becoming more popular because we can scale them, use them efficiently, and they can deliver real-time detection of fraud on various digital payment channels. These solutions can be effortlessly integrated with AI and machine learning algorithms to further enhance their predictive power and trade off false positives in transaction monitoring. The adoption of remote payment infrastructures, e-commerce transactions, and the growing usage of digital banking further contributed to the growth of the segment. Furthermore, the addition of enhanced cloud architecture security, adherence to international data protection standards, and increased capacity for implementing in older architectures are also making financial institutions switch towards cloud architectures. Cybersecurity demands are changing, and cloud-based fraud detection solutions will only grow in their constantly questioned and innovative characteristics, agility, and automation.

According to the report, the impact of the Credit Card Fraud Detection Platform has been identified as high for the North America region. Some of how this impact has been felt include:

North America currently dominates the world credit card fraud detection platform market and is expected to remain so during the forecast period. The region also enjoys the company of leading financial institutions, fintech firms, and payment service providers that early adopt advanced fraud prevention technologies. The U.S. and Canada are leading with innovation in digital payment because of the popularity of credit and debit cards, contactless banking, and online shopping platforms, which demand advanced fraud systems. The existence of stringent regulatory laws like PCI DSS and consumer protection laws continues to push organizations into investing in powerful security and fraud detection facilities. Also, the concentration of artificial intelligence (AI), machine learning (ML), and the development of behavioral analytics into payment security systems is improving fraud detection in the area, making it more accurate and faster. The potentially massive investment levels in R&D, the rise in cybersecurity awareness, and the concentration of global technology giants in the region make North America the most active region in identifying the future of the global credit card fraud detection platform market.

Click here to view the Report Description & TOC https://univdatos.com/reports/credit-card-fraud-detection-platform-market

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Deployment, By Technology, By End-User, and By Region/Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Related Reports :-

MENA Card Payment Market: Current Analysis and Forecast (2023-2030)

Middle East Buy Now Pay Later Market: Current Analysis and Forecast (2024-2032)

India MSME Payment Risk Management Solution Market: Current Analysis and Forecast (2024-2032)

Speech-to-text API Market: Current Analysis and Forecast (2022-2028)

Streaming Analytics Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Sports

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Shopping

- Theater

- Wellness